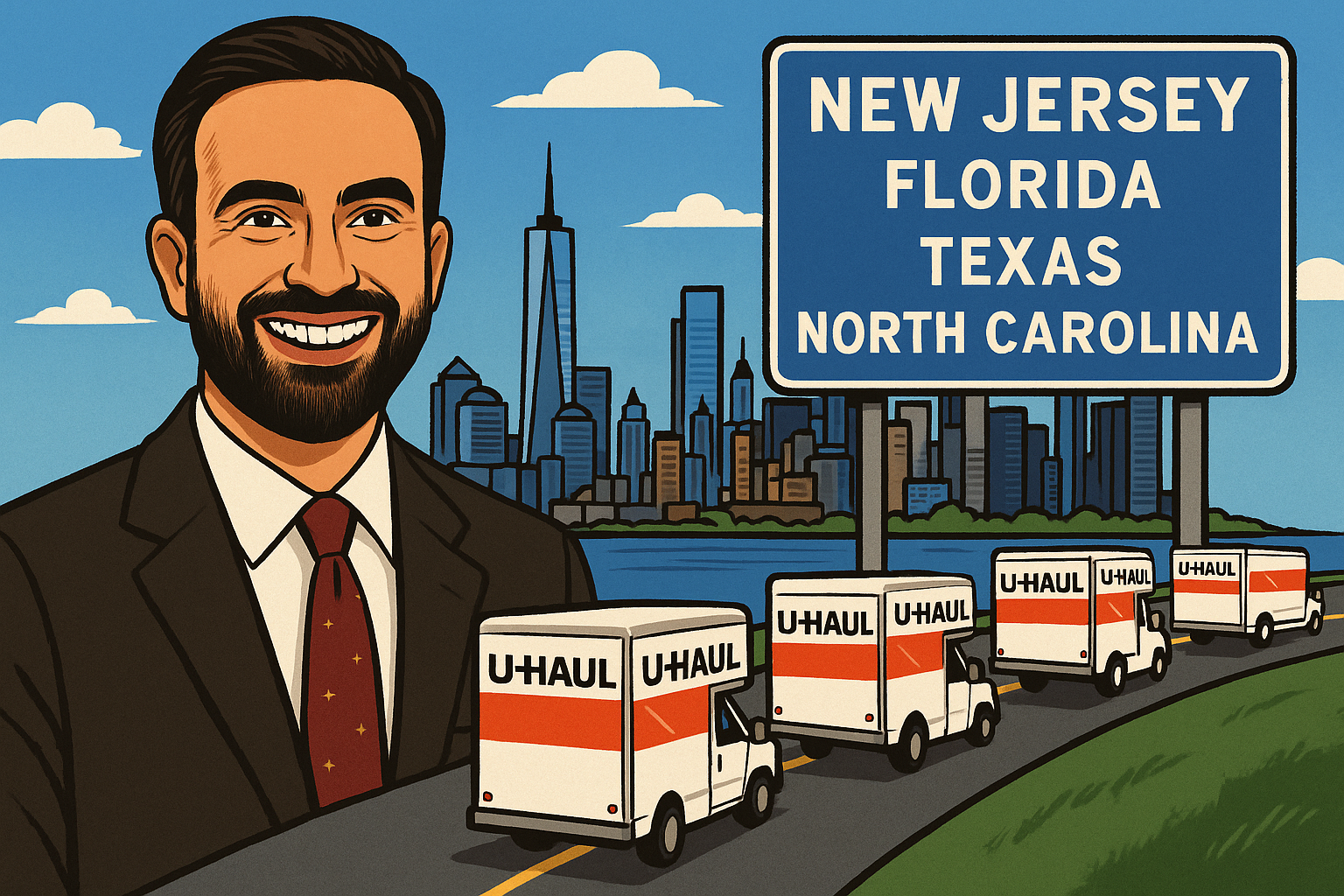

Now That Zohran Mamdani Is Mayor: Will NYC Residents Move to New Jersey… or Skip Straight to Lower-Tax States?

Where Are New York City Residents Going to Move After the Mayoral Election?

Zohran Mamdani is officially the Mayor of New York City. For some voters it is historic. For others it is a warning. And for many wealthy New Yorkers, it is a signal to leave before taxes, regulations, and city policies tighten.

📞 Across the suburbs, agents report calls from Manhattan and Brooklyn sellers who want out fast. Homes in Westchester, Bergen County, and Fairfield County are getting strong activity, competitive offers, and buyers who are ready to move immediately.

But there is a major shift happening beneath the surface:

✅ During COVID, New Jersey was the automatic landing spot

🚫 Today, many NYC residents are asking whether they should skip New Jersey entirely and move somewhere cheaper long-term

🏠 Why NYC Residents Moved to NJ During COVID

During the pandemic, New Jersey real estate exploded because:

• Remote work killed the commute

• Families wanted space, yards, and home offices

• Interest rates were low

• NJ was cheaper than Manhattan and Brooklyn

• Schools and suburban life felt safer and more stable

Towns like Ridgewood, Wyckoff, Montclair, Livingston, Westfield, and Summit saw bidding wars, waived inspections, and homes selling within days. NYC shrank while New Jersey surged.

But today’s market is different.

Rates are high. Budgets are tight. And many families are not just escaping New York City… they are escaping high-cost states entirely.

✅ Yes, New Jersey Is Cheaper Than NYC

…but still expensive

Compared to Manhattan or Brooklyn, NJ feels like a bargain:

• Lower housing costs

• Lower everyday living expenses

• No NYC income tax

• More space and better schools

This is why NYC homeowners still buy here. Bergen, Essex, Morris, and Union counties will always get some demand.

However, many buyers are asking a bigger question:

💡 Why settle for “cheaper than NYC” when they can have low taxes, warm weather, and a lower cost of living elsewhere?

🌴 Where Many NYC Residents Are Going Instead

The most popular destinations:

✅ Florida

✅ Texas

✅ North Carolina

✅ South Carolina

✅ Tennessee

✅ Pennsylvania (for those staying near family)

These states offer:

• No state income tax (in several cases)

• Lower housing and insurance costs

• Cheaper retirement

• Warmer weather

• Better financial upside

New Jersey is cheaper than NYC, but it is not cheap. And with NJ electing Democratic Governor Mikie Sherrill, taxes and regulation are unlikely to decrease.

🚚 The Part Politicians Do Not Like to Admit

New York is losing residents.

New Jersey is too.

Every year, thousands of NJ homeowners sell and head south or west because:

• Property taxes are the highest in America

• Utilities and insurance are expensive

• Retirement dollars stretch further elsewhere

• Weather is brutal half the year

• Remote work allows freedom

Florida remains the number one destination for former New Jersey residents. Texas and the Carolinas are not far behind.

📉 What This Means If You Own a Home in NJ

Right now, there are still motivated NYC buyers who are:

✔ Paying strong prices

✔ Buying fast

✔ Looking for stability outside the city

But markets do not stay hot forever.

If more buyers decide to skip NJ and head straight to Florida, Tennessee, Texas or the Carolinas, demand here will soften. When demand softens, prices follow.

If you are thinking about selling, this could be the strongest window you will see:

✅ Prices are historically high

✅ Buyers are still active

✅ Your equity is at its peak

✅ You can relocate somewhere financially lighter

🌎 Thinking About Leaving New Jersey?

You are not alone.

Homeowners across Bergen, Passaic, Essex, Morris, Monmouth, Middlesex, Union, Somerset, and Ocean counties are selling and relocating to states where taxes are lower and life is simpler.

Popular choices:

• Florida

• Texas

• North Carolina

• South Carolina

• Tennessee

• Pennsylvania

• Arizona

Whether you are retiring, downsizing, escaping taxes, or just want more sunshine, the process is simple:

Sell your NJ home for top dollar

Move your equity to a lower-cost state

Live better for less

I can list your home here in NJ, and I can connect you with a trusted, top-performing agent anywhere in the country.

✅ Final Thought

Mamdani’s election has wealthy New Yorkers preparing their exits. Some will still land in New Jersey. Many will not.

At the same time, New Jersey homeowners are asking:

💭 “How long do we want to pay the highest taxes in America?”

If you have been thinking about leaving, this is the time to explore your options while demand is strong and prices are high.

Want to know what your home is worth or need a trusted agent in Florida, Texas, Tennessee, or the Carolinas?

Send a message. Your next chapter could start sooner than you think.